“As for you, be strong and do not give up,

for your work will be rewarded”

2 Chronicles 15:17

We did it!

We are pleased to report that Team CC Associates have all survived the craziness of January!

We want to thank each and every one of our clients for trusting us with their work, and helping us get through January (…especially those who brought us chocolates, tissues – and gin! – when times got tough and we all wanted to leave and just work in Tesco instead!)

Some things we’ve noticed that will help us help you out – and help reduce fees to the client…

Open your envelopes and bills!

You would be amazed how many people don’t even do this. Think of mine and Tara’s nails, please!

Check out http://www.zhoozh.co.uk/

Put your paperwork in monthly order!

Tara loves her job, but sitting on the floor surrounded by paper is probably against some kind of health and safety practice!

Unfold your receipts…

We cry inside every time records come in with fuel receipts folded into tiny pieces – and then each and every one has to be unfolded, which takes time. We love millions of receipts and piece of paper, but Origami is definitely not our forté!

Remove non work-related expenses…

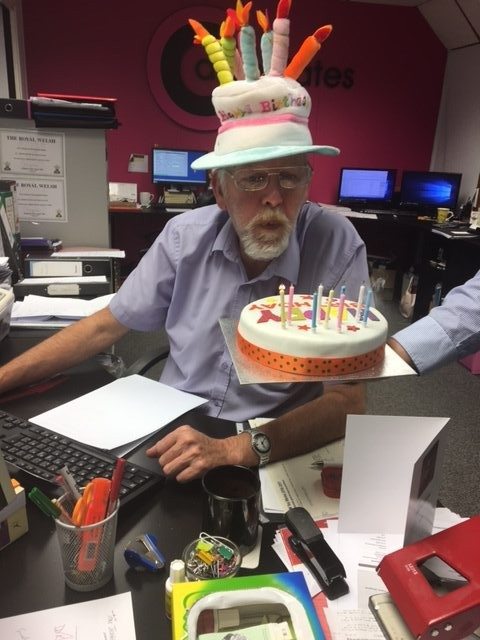

Tim loves a good curry, and is a rather amazing curry chef himself (see pic, looks good eh?) – but he really doesn’t need to see what you and your friends ate for dinner at the local Indian restaurant!

Likewise, we don’t need your receipts for the lovely shorts and trainers you bought in the sports shop.

Sadly, this is not tax deductible, even though Richard thinks it should be, and is probably campaigning behind the scenes to make it be in the future.

He may love football and cricket, but we just don’t think he is going to change the taxman’s mind, sadly..!

In other news…

As you may know, the filing deadline for reporting income between 6th April and 5th April every year for Self Assessment Tax returns is 31/01 every year.

https://www.gov.uk/self-assessment-tax-returns/deadlines

Tim has a saying in our office: “Some people think it’s a target, not a deadline!”

What this means is that people can file as early as April 7th every year, but some leave it to the following January to actually do it.

This comes with its own issues, not just for us. Facing huge amounts of processing and tax work (and black bags of random pieces of paper..) being brought to us unceasingly during January, but for Clients as well.

Let’s take an example of one of our clients, who brought us a stack of information to process on 22nd of January.

By the time we go through everything and produce a tax return, it is only at that point that the Client then finds out how much tax they owe.That tax is then due to be PAID by 31st January.

This comes as a shock, and usually the client has no idea until right before the payment deadline how much they need to pay.

There is a worse shock to come if they can’t pay it all, HMRC can then add the further penalties:

5% of tax unpaid after 30 days, another 5% of tax unpaid after 6 months, another 5% of tax unpaid after 12 months…!

So, what is the solution to all of this? How can people ease the burden of leaving things right to the wire and expecting and hoping all will be well?

Here are some handy basic tips (Not involving any maths at all!)

• Keep all your records of income and expenses in monthly order

• Every month, go through these pieces of paper and put them into categories (Fuel, Purchases, and

Repairs etc. etc.)

• Work out how much money you have taken (Sales) – and how much money you have spent

You will now have a very basic idea of your “Profit” – which is what is subject to tax (at 20% or 40%, depending on your level of profit)

If you do this every month, and then get your paperwork in as soon as possible after April 6th, you will then know, in plenty of time, how much tax will be due in 9 months time – the following January.

If you are feeling a bit computer-savvy, and can input even the most very basics of information, take a look at our special software here, and let us know if you would like to use this. https://www.diamondwebapps.com/ccassociates/signup.pl

Some people think if they get us to calculate their tax returns just after 6th April, they have to pay the tax then. That is incorrect, the tax is still not due until 9 months later. So it is a no brainer to not do it as soon as possible after 6th April, every year.

We look forward to seeing you all on April 7th, lined up in an orderly queue at our door with your beautiful records, ready to start your next years returns!

Thank you from us all. WE DID IT!!!!